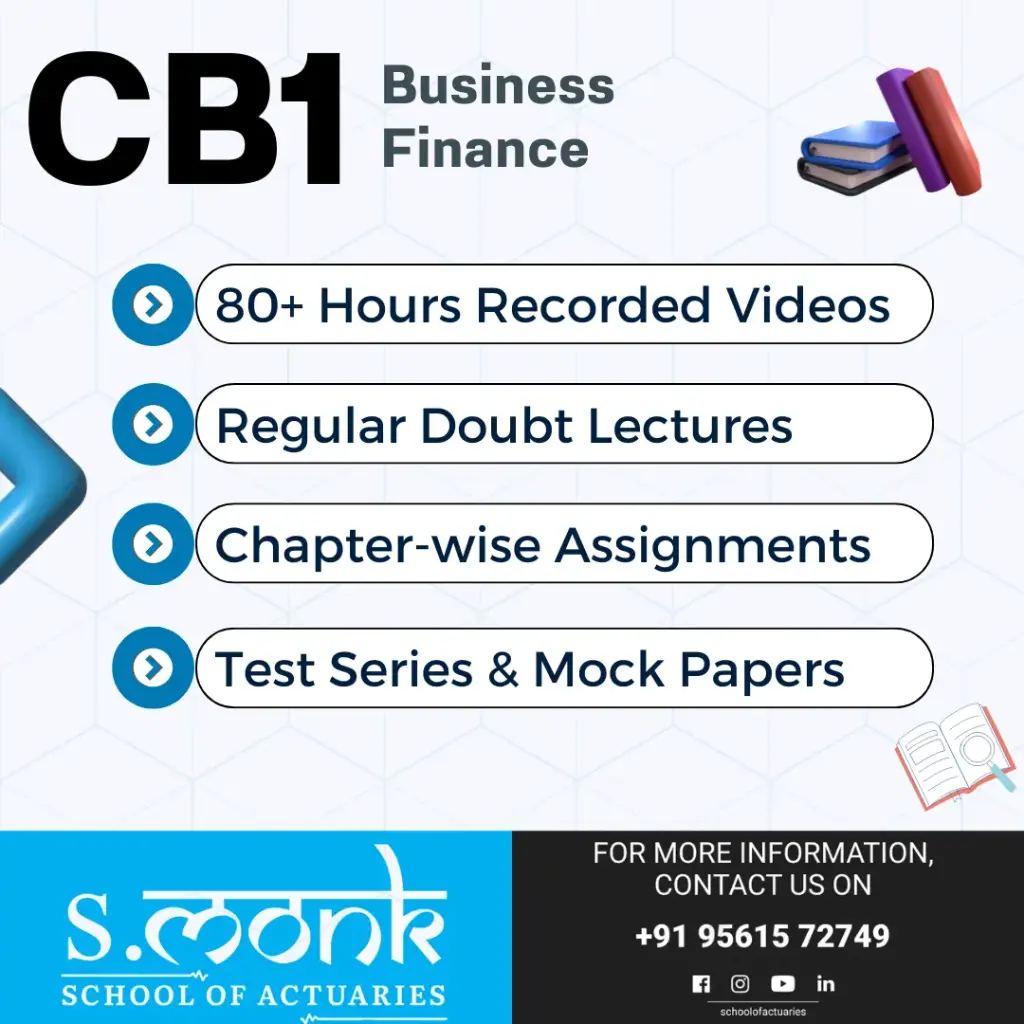

S.MONK | Pre-recorded Video Course | Total Fee: ₹10,000

CB1 Demo Lecture 1 by Ravi vyas

Understand the financial environment, corporate finance, and business strategy — essential for every future actuary.

Course Overview

CB1 introduces core principles of financial reporting, corporate governance, company structures, and financial management. It builds the commercial awareness actuaries need to interact effectively with finance professionals in insurance, pensions, banking, and consultancy.

Offered by both IAI and IFoA, this paper helps develop a practical business mindset alongside technical actuarial training.

What You Will Learn

- Company types, objectives, and ownership structures

- Basics of accounting and financial statements (balance sheet, income statement)

- Investment appraisal (NPV, IRR, payback method)

- Sources of finance (equity, debt, working capital)

- Cost of capital, gearing, and dividend policies

- Financial ratios: profitability, liquidity, efficiency

- Corporate governance and business ethics

- Risk management in business decisions

Why CB1 is Important

- Builds understanding of how companies make financial decisions

- Enhances your commercial and strategic thinking

- Useful in pricing, reserving, and investment strategy work

- Highly recommended alongside CM1 or CS1 for early placements

Exam Format

Exam Type |

Duration |

Mode |

|

Objective + Scenario Questions |

3 hrs (approx.) |

Computer-Based (IAI/IFoA) |

Passing Criteria

Institute |

Passing Marks |

|

IAI (India) |

50% (fixed) |

|

IFoA (UK) |

50% To 60% (varies by session) |

S MONK Tips to Crack CB1

- Understand accounting logic behind balance sheets & income statements

- Practice ratio analysis & business case studies

- Master investment decision tools like NPV & IRR

- Focus on real-life applications & governance frameworks

Who Should Enroll?

Students from non-commerce and commerce backgrounds

Those aiming for roles in actuarial consulting, banking, or corporate finance

Ideal to pair with CM1 or CS1